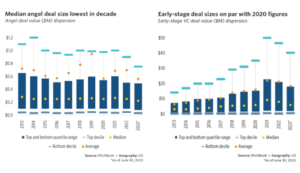

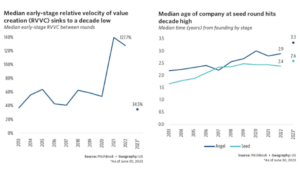

The first half of 2023 shows a continuing shift in the landscape of early-stage venture capital (VC) deals. Amidst an environment of high interest rates and increased portfolio company cash burn, VC funds are deploying capital more carefully. This has had a noticeable impact on angel and seed-stage deals. According to Pitchbook’s Q2 2023 US VC Valuation Report (1), the median angel deal size hit a 10-year low in H1 2023, while the median seed pre-money valuation fell 16.7% quarter-over-quarter, to $10.0 million in Q2 2023. As a result, seed-stage companies have exhibited a greater tendency to delay raising Series A rounds, instead preferring to extend prior rounds.

As funding for early-stage companies stagnates from the rush of pandemic-era highs, what does this mean for valuations? With the reduced frequency in funding, recent indications of value (namely, rounds of financing) are beginning to dwindle. Coupled with limited financial metrics, infrequent company-specific updates, and often limited information rights, valuing early-stage companies becomes increasingly challenging. Additional scrutiny from limited partners as well as auditors means that having accurate and timely marks is more important than ever.

Houlihan Capital is aware of these growing challenges and continues to work with clients to develop accurate, reasonable, and defensible valuations for stale marks. When tasked with measuring fair value for financial reporting purposes, our valuation approach is informed by the AICPA valuation guide, Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment Companies. The valuation guide lays out some helpful best practices for these situations. One common solution is to apply a calibration method. Chapter 10 of the guide outlines a calibration method as follows:

“Calibration is the process of using observed transactions in the portfolio company’s own instruments… to ensure that the valuation techniques that will be employed to value the portfolio company investment on subsequent measurement dates begin with assumptions that are consistent with the original observed transaction as well as any more recent observed transactions in the instruments issued by the portfolio company. On the original transaction date…using the selected valuation techniques with the calibrated inputs will result in a fair value of the portfolio company investment that equals the transaction price. At subsequent measurement dates, these input assumptions (for example, financial metrics for the company such as revenues and EBITDA, projected revenues and EBITDA, or projected cash flows; non-financial metrics for the company including specific operating key performance indicators such as number of customers, volume, efficiency measurements, and so on; and market-related inputs such as valuation multiples, cost of capital, or other factors) should then be updated to reflect changes in the investment (e.g., portfolio company performance and expectations) and changes in market conditions (e.g. valuations, cost of capital, etc., in the relevant universe of guideline public companies).”

As the first step in applying this guidance, we often estimate the portfolio company’s equity or enterprise value at the time of initial investment by reference to the initial investment. By leveraging the relevant details of this “original observed transaction,” such as purchase price, deal terms, the company’s capital structure, etc., this can typically be done relatively simply with one or more generally accepted techniques.

More judgment is frequently required beginning with the second step of applying the calibration method, which is anticipated to be the solving of a key valuation model input (e.g., EV-to-EBITDA multiple). Here a challenging fact pattern may begin to force expert interpretation of, or sometimes extrapolation from, the text of the AICPA guide. For example, the recency of investment, the portfolio company’s stage of development, and/or information constraints may mean that company-specific metrics (e.g., EBITDA) cannot or should not be used. For similar reasons, use of forecasted financials and an income approach may also be impractical. In such cases, it is common for valuation practitioners to adopt a simplified procedure whereby direct quantification of changes in market conditions is emphasized and company-specific developments (to the extent any are known) are relegated to being a secondary, layered consideration. In practice, this can look like adjusting the implied equity value by a percentage selected based on the movement of market capitalizations of comparable public companies from the date of investment to the current measurement date.

When valuing an early-stage company, the truth of the matter is that there is no formulaic solution, and no guide can ever be truly comprehensive. It takes expert knowledge and experience to arrive at conclusions that consistently make sense and are defensible. We suspect this is part of the reason why our firm has received a record number of referrals for, and inquiries about, our VC valuation services in recent months. Added to the long-term trend of funds of all types being held more strictly to fair value accounting standards, the recent deceleration in VC funding activity has seemingly pushed more VC fund managers to finally enlist the services of independent third-party valuation firms. We welcome the challenge.

Houlihan Capital is a leading, solutions-driven, valuation, financial advisory, and investment banking firm committed to delivering superior client value and thought leadership in an ever-changing landscape. The firm has extensive experience in providing objective, independent, and defensible opinions of value that meet accounting and regulatory requirements. Our clients include some of the largest asset managers around the world, and ’40 Act funds, private equity funds, hedge fund advisors, fund administrators, and other asset management firms benefit from Houlihan Capital’s comprehensive valuation and financial advisory services. Houlihan Capital is SOC-compliant, a Financial Industry Regulatory Authority (FINRA) and SIPC member, and committed to the highest levels of professional ethics and standards.

For questions regarding valuation services for Venture Capital funds, please contact:

Daniel Sill

Daniel Sill

Senior Associate

dsill@houlihancapital.com

_________________________

(1) Pitchbook (2023, August 9) Q2 2023 US VC Valuations Report. Pitchbook. Retrieved from https://pitchbook.com/news/reports/q2-

2023-us-vc-valuations-report

(2) AICPA. (2023). Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment

Companies - Accounting and Valuation Guide.