Introduction

At a recent industry conference, questions from fund managers and advisors highlighted both the growing interest in interval funds and the confusion surrounding their structure, liquidity mechanisms, and valuation requirements. These conversations underscored how rapidly interval funds have evolved from a niche investment structure into one of the fastest-growing segments of the retail alternatives landscape.

Created under the Investment Company Act of 1940, interval funds allow managers to invest in private credit, private equity, real estate, and other illiquid asset classes while offering shareholders periodic liquidity through redemptions at net asset value ("NAV"). Unlike traditional mutual funds, interval funds are not required to provide daily redemptions. Yet many interval funds choose to strike a daily NAV, even when underlying investments are valued monthly or quarterly. As a result, this creates a unique tension between the frequency of pricing and the illiquidity of the portfolio and thus has drawn the attention of regulators, auditors, fund boards, and investors.

This article provides an in-depth examination of interval fund structure and their rapid growth, informed by recent market conversations and Houlihan Capital's work with fund sponsors, boards, and advisors navigating this evolving landscape. It draws upon regulatory guidance, market observations, and practical insights.

1. Understanding Interval Funds: Structure, Benefits, and Constraints

Interval funds are closed-end investment companies that provide periodic liquidity through repurchase offers. They do not trade on an exchange and instead rely on mandatory repurchase programs to provide liquidity at NAV. This hybrid structure has positioned interval funds as an increasingly popular vehicle for retail access to private markets.

- Structural Characteristics: Interval funds are permitted to invest in a broad range of assets, including private credit, private equity, infrastructure, real assets, and other alternatives. A base management fee is usually charged along with an incentive fee in many cases. Leverage is capped at 1:2 for debt and 1:1 for preferred stock. These structural features allow managers flexibility to pursue private-market strategies while providing investors access to institutional asset classes.

- Benefits of Interval Funds: Interval funds offer exposure to private markets that historically have been inaccessible to most individual investors. The exposure to private markets allows for an increase in diversification since most individual investors’ portfolios consist primarily, if not exclusively, in public market securities. Public-market exposure has become increasingly concentrated, with the top 10 companies in the S&P 500 now representing roughly 40% of the index’s total market capitalization, resulting in significant concentration risk even in broadly diversified index funds. By contrast, private-market investments span a wider range of industries, capital structures, and stages of company maturity, providing exposure to return drivers not present in public equities. Additionally, private equity and private credit have historically delivered higher risk-adjusted returns across both short- and long-term horizons, driven by value-creation levers and market inefficiencies that cannot be replicated in public markets. Interval funds allow individual investors to incorporate these private-market exposures into their portfolios, enhancing diversification while avoiding daily-liquidity pressures that can force asset sales during periods of market stress. This structure supports a more stable portfolio and helps preserve long-term value.

- Weaknesses and Constraints: Interval funds are complex to launch and administer. Distribution-platform requirements, custodian restrictions, and regulatory reviews can extend the launch process for years. Additionally, investors often misunderstand daily NAVs as implying liquidity; in reality, redemptions are capped and repurchases occur periodically. Valuation challenges are significant especially for funds investing in private assets with limited observable inputs. Boards and valuation designees face heightened governance expectations under Rule 2a‑5, including oversight of pricing services, stale mark processes, and valuation methodologies.

2. The Rapid Growth of Interval Funds

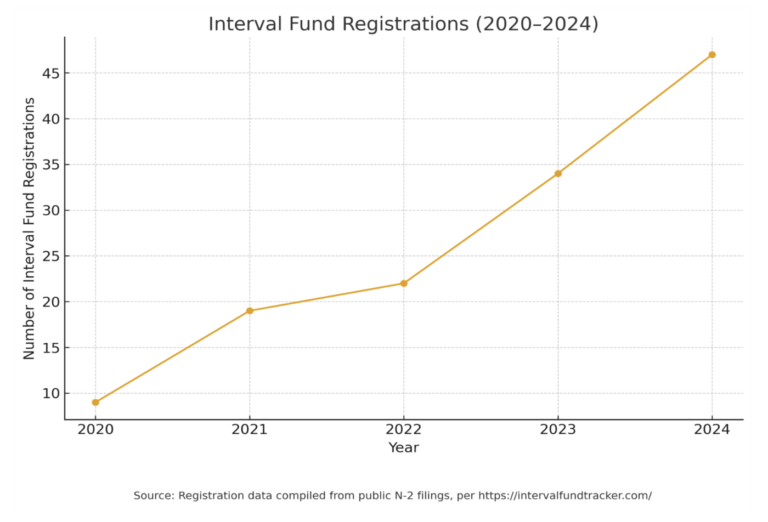

Interval funds have experienced substantial growth over the past five years. According to industry research, the market now comprises more than 300 interval and tender-offer funds, representing more than $215 billion in net assets.1 Additionally, interval fund registrations increased from 22 new filings in 2022 to 34 in 2023 and 47 in 2024, reflecting year-over-year growth rates of approximately 55% and 38%, respectively. This sustained rise in annual fund launches highlights both growing sponsor participation and expanding investor demand for semi-liquid access to private credit, private equity, and real asset strategies.

- Key Drivers of Growth: Several factors underpin the expansion of interval funds. Investor demand for private credit and other alternative income-generating assets has surged as public fixed-income markets face yield compression. Traditional exit channels such as IPOs and mergers have slowed as well resulting in an increased demand for alternative vehicles that can hold illiquid assets while offering limited liquidity.

- Market Composition: Private credit represents the largest allocation within interval funds, accounting for more than 40% of managed assets. Private equity and venture capital represent more than 25%, followed by real estate and hedge fund strategies.2 This concentration reflects broader market trends in private capital, where direct lending has outpaced traditional private equity fundraising with private company fundamentals remaining resilient compared to public markets.

- Comparative Performance: While interval funds themselves lack long-term public performance benchmarks, listed closed-end funds offer useful parallels. Per Morningstar Direct, as of September 30, 2025, data shows that listed closed-end funds have outperformed comparable mutual funds and ETFs on a NAV basis in the last three years due to structural advantages in most industries, with exception to large blend, technology, and energy limited partnerships. These parallels underscore the potential return benefits of semi-liquid vehicles that can pursue long-term private-market strategies without the pressure of daily redemption.

Conclusion

The continued expansion of interval funds reflects a broader transformation in how investors access private markets and how sponsors deliver semi-liquid exposure to alternative asset classes. As these vehicles scale, the demands for disciplined valuation practices, transparent governance, and robust operational oversight will only increase especially as interval funds balance the complexities of illiquid investments with the expectations of more frequent NAV reporting.

In the next installment of our series on interval funds, we will explore the valuation challenges these vehicles face, including fair-value considerations, oversight requirements, and the unique dynamics created by more frequent NAV reporting.

Houlihan Capital is well positioned to support sponsors, boards, and advisors navigating this evolving landscape adhering to ASC 820 and Rule 2a-5 compliance. Our team brings deep experience in valuations, helping clients maintain defensible, transparent, and well-supported valuation processes across a wide range of private-market strategies.

Contact us to learn how our independent valuation expertise can enhance the integrity and scalability of your interval fund.