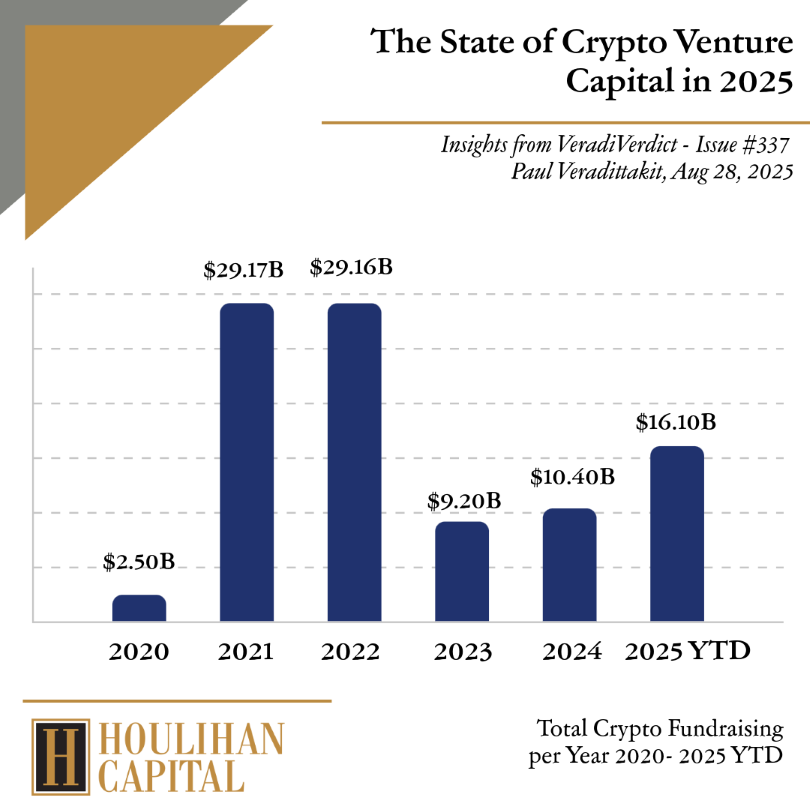

Insights from VeradiVerdict – Issue #337 (Paul Veradittakit, Aug 28, 2025)

Record-Breaking Growth

Crypto companies have already raised more than $16 billion year-to-date in 2025, with over 100 M&A deals announced—surpassing the total deal value of 2024 and positioning the industry for a historic year.

This cycle is fundamentally stronger than past ones, driven by:

- Regulatory clarity in the U.S. and abroad

- Institutional adoption and strategic consolidation

- IPO resurgence, with nearly 100 crypto-related listings on U.S. exchanges

Momentum Is Accelerating

IPO Market Re-Opening: Circle's June 2025 IPO priced at $31 per share and surged to $233 within weeks, creating a $44.98B market cap. Other major players like BitGo and Bullish are fueling an active pipeline.

M&A on Pace to Triple 2024: 2025 has already seen $6.23B in deals, led by strategic moves like Robinhood's acquisition of Bitstamp, signaling industry maturation.

Legislative Tailwinds: Pro-crypto acts such as the Genius Act and Clarity Act, alongside expected Fed rate cuts, are unlocking capital and reducing investor hesitancy.

Convergence with Technology and Finance

AI Integration: Decentralized AI platforms and blockchain-based identity systems are shaping the future of intelligent, secure digital transactions.

Payments Transformation: Stablecoins, particularly USDC, are seeing accelerating adoption, with projections of $250B daily transaction volumes within three years.

Institutional Alignment: Traditional finance is increasingly merging with crypto rails, validating blockchain's role in mainstream markets.

Looking Ahead

With record fundraising, strategic M&A, robust IPO activity, and regulatory clarity, 2025 is establishing the foundation for the most structurally sound growth cycle in crypto's history. The convergence of blockchain with AI, payments, and traditional finance marks a decisive step toward cementing crypto as a pillar of global finance and technology.

This surge in crypto VC activity signals a maturation of the ecosystem. As deal volumes increase and institutional capital flows in, fund managers can expect heightened LP scrutiny and more rigorous audit requirements. The regulatory clarity driving this growth cycle means valuations will need to meet traditional institutional standards while navigating crypto-specific complexities.